With the changes to Levy Management, the below page includes some of the most frequently asked questions around how this area works.

The content in this article is applicable to StrataMax version 5.6.135 and higher.

Levy Year

Q. What is a Levy Year?

A. The Levy Year is the levy periods that you are about to resolve at the upcoming AGM.

Q. When do I have to change my levy year?

A. In planning for the next AGM.

Q. My levy year is several years behind - do I have to update this for every building?

A. Not initially - only as each building prepares for AGM. You can edit the Levy Year to the required year. Watch our video on how to set the Levy Year to match the AGM levy decisions, where we demonstrate how to update the Levy Year.

Q. How does the Levy Year calculate the levies?

A. Tip is to hover over the levy period to see the calculation. Calculation is the annual rate per unit of entitlement (U/E) and distributed evenly across four quarters, or according to the number of instalments defined.

Rate = (Next Year Budget - Outstanding Levy Income / Entitlements / Remaining Instalments).

Budget

Q. If there is no Next Year Budget what is used to calculate the levies for periods in the next financial year?

A. Current Year Budget will be used to calculate the levy periods, however these can be edited if required.

Q. I need a report to show the quarterly proposed levies for each lot.

A. In Levy Management, produce the Levy Register - Quarterly for a breakdown report for each lot.

Levy Management

Q. What has Strike been replaced with?

A. Approve Levies.

Q. Where can I find the Levy Balance Control Report?

A. Levy Balance Control Report can still be produced from Levy Notice/ Reports under Options. The Levy Generation Schedule can be used and this is a global report accessible in the Reports menu of Levy Management. When in the Create Transactions and Notice - there is also a preview of the levies about to be issued.

Q. How to enter $0.00 levy in new Levy Management?

A. $0.00 levies can be entered using Add - Manual, when the Gross Amount per U/E is 0.00 a validation box will appear and must be checked to confirm the levy is a $0 levy (the Zero Levy checkbox will only show if $0 amounts are entered into the rate per U/E or Gross Total Amount).

Q. How do I create Special Levy?

A. The Levy Invoice Code will need to be created or exist already in Levy Invoice Code Setup and have the Type set to 'Special'.

Q. Old levies are appearing in Levy Management and on Certificates; how can these be removed?

A. In Levy Management select Options and then Set Current Levies and untag any levies as required. The levies will still be available to report on and display in Levy Management by ticking Show Historical Levies.

Q. I am trying to enter levies for a new building using Add - By Budget and they are not being created.

A. Check Levy Invoice Code Setup for the Instalments. Review and set Base Building as required.

Q. I would like to print a Levy Register Summary Report; how can this now be done?

A. The Levy Register is now two reports, so from Levy Management / Reports you can select from the two. Within the report distribution screen you can add the additional report so both are included if required and this may be saved as a report set for quicker access.

Q. Do you need to re-enter the custom schedule and owners on interest free list or do these get copied over?

A. This information will be included on upgrade.

Q. Where can we watch the Levy Management recording?

A. The webinar recording can be located on our Live Sessions article as well as under StrataMax Videos.

Q. Is the levy year end rollover only available when you add new levies by budget (not manual)?

A. Yes, when you select Add - By Budget you can adjust the Levy Year. You can untag the levy periods being created if preferred.

Q. Can levies still be issued globally?

A. Yes, from Create Transactions & Notice in Levy Management you can select Buildings and tag all.

Q. Do the levy screens show inclusive of GST or exclusive of GST?

A. Levies to owners are always inclusive of GST.

NOTE: GST will be automatically applied to budget amounts for Net GST style buildings on Levy Year rollover.

Q. If you have custom schedules can you not add by budget? Does it have to be done manually?

A. Yes they will need to be created manually as the custom schedule is not available to be used adding from budget.

Q. When adding by budget what levy types can be used?

A. Levy Invoice Code Setup with a Type of (Regular) levies, which may include additional levies or Trading Fund levies.

Q. There is a message "Budget not set for accounts:" in Levy Management, what does this mean?

A. Budget Accounts that do not have any data entered in Budget Update will be displayed as a warning only in the Add Levies by Budget screen.

Q. We previously used Set Levy Notice Date to enter levies issued by prior / previous managers, how is this now done?

A. When entering the levy information, use Prior Manager as the Type. The old Set Levy Notice was used to mark a levy as generated and was commonly used when buildings moved between managers and were loaded into StrataMax manually.

If old levies have not been generated; these should be investigated as to why and either set as a previous manager levy or generated if required or deleted from Levy Management. Tick Show Historical Levies to view all levies and to be able to access the edit and delete buttons.

Q. I need to issue an urgent special levy, the Due Date does not need to be adjusted / updated.

A. There is a setting for Override Due Date Validation which can be ticked to allow the Due Date to remain and not adjust on generation. See Override Due Date Validation for more information.

Q. How to update the Approved / Determined date for a future non Generated Levy Period?

A. To update the Approved / Determined Date for a Levy Period, click the Edit button on the levy and then Save without making changes, then click Approve and the levy will be available so the Approve Date can be changed.

Q. How can I update the message displayed on the Levy Notice?

A. Use Message Maker icon and select Levy Notice to add/ edit the message on the Levy Notice.

Q. Does the Levy Register Quarterly Reports show Insurance levies.

A. Yes.

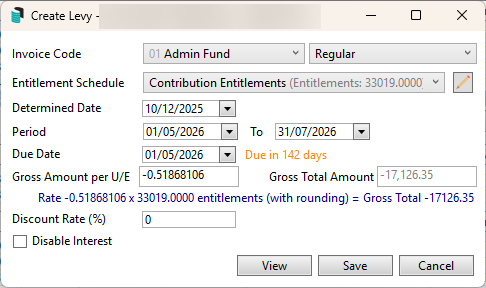

Q. Can I enter a credit levy into Levy Management?

A. Yes, when adding the manual period using the standard entitlement schedule(s), use the "-" symbol to create the credit, approve and create transactions and notice as necessary.

Levy Notice Distribution

Q. Where can I find a copy of a sent Levy Notice?

A. Levy Notices are saved to DocMax and can have a Profile set when Save to DocMax option is ticked in Report Distribution allowing Levy notices to be stored to a specific Category. Levy Notices can also be viewed from the Roll Document List shortcut in the Roll - note you can highlight and select multiple to send at once using SHIFT or CTRL keyboard buttons to highlight, and then right click to Email or Print. From version 5.6.139 the new Stored Reports will be available which will include documents from the old Stored Reports and also documents stored in DocMax that were created from Report Distribution with Save Report ticked.

Q. When agents are being sent levy notices; how can we ensure the owner receives a duplicate notice?

A. This can be done one of two ways; depending on if you wish to manage this on a global basis or lot by lot. Duplicate notices are only sent to owners who have their levy distribution preference set to Email.

Lot by lot Basis - Ensure the setting in Distribute Levies under the filters 'Duplicate - Email copy to owner' is unticked as this is only used if wanting it applied globally. Then within the specific lots who want a duplicate sent tick the 'Copy to Owner (Duplicate Notice)'.

Global Basis - In Distribute Levies under the filters ensure 'Duplicate - Email copy to owner' is ticked.

Q. How to issue a Levy Notices for multiple buildings generated on a previous day (Re-Issue Levy Notices)?

A. Adjust your Working Date back to the date of Generation. Then from Levy Notice / Reports click Select Buildings and tag All / Proceed.

Q. When levy notices are produced and emailed; sometimes the postal address is not appearing why is this?

A. The postal address will not displayed when emailed when the lot includes multiple contacts with postal addresses. From version 5.6.139 if you wish to include the postal address of the first contact on the roll in the Levy Notice configuration tick the option 'Require Postal Address Even for Email'.

Levy Management & Meeting Hub

Q. We often have to manually populate information on meeting notices which can result in human error; does meeting hub allow merging of levy information?

A. Meeting Hub includes merge fields relating to unstruck (not approved) and struck (approved) levies. Ensuring your levy year matches the levies being voted on the AGM helps make the process as efficient as possible.

Standard Motions should be setup to suit your needs based on how many interim levies are used & for GST registered and non GST registered buildings. For example, a building that has an AGM during the first quarter of a financial year may use a motion similar to the below (as this would have one interim levy), where as a building that has an AGM during the second quarter of a financial year may use a different standard motion with two rows of struck levies and four rows of unstruck levies (as this would have two interim levies).

Example of a standard motion; in the below example the first row of levies is using the struck merge field category as this is the levy approved at the last AGM, and the remaining four rows use the unstruck merge field category as these levies are waiting to be approved at the AGM.

In the below example; prior to the AGM the levy year has been rolled to create the required levies.

What is merged into the motion; motions can be edited further if required. Additional fields are available if required.

Removed items

Configuration

Add GST to budget amounts at year end rollover

Suppress rationalisation for current building

Always show list of levies

Allow period date override

Minimum Arrears Amount - moved to Arrears Notice config

GoTo

Change Levy Code

Levy renumber

Edit Levy Paid Dates

Levy Balance Control Report is only applicable at the time the levy is generated

Transfer Credit Funds