|

|

May 2025

Welcome to our Training Newsletter for May.

As we step into a new month, we’re excited to bring you fresh updates, training opportunities, and practical tips to help you get the most from StrataMax.

This month we are showcasing a webinar at the end of the month to help you keep up with the ever-changing enhancements – keep reading to find out more and register for this fun session.

On a more serious note, with the end of tax year quickly approaching, now is the perfect time to refine your skills and ensure you’re prepared for upcoming reporting requirement – join our session for Income Tax.

|

|

|

|

|

|

|

|

StrataMax Webinar Videos

All of our previous webinars are available for viewing at your convenience on our StrataMax Videos page, so don't forget to check out those if you missed anything!

|

|

|

|

|

|

|

|

Coming Soon | Discover ‘What’s New’

We know your time is valuable—so we’re making it easier than ever to stay across the most important updates in StrataMax. Soon, you’ll notice a helpful new icon: ‘What’s New’.

This feature gives you a quick, at-a-glance summary of standout enhancements and key improvements—perfect for those moments when you want to catch up on major changes without digging through full release documentation.

What does it mean for you?

- Instant visibility of significant new features

- Stay informed with quick, high-impact summaries

- No more guesswork—know what’s new, when it matters

The ‘What’s New’ icon isn’t meant to replace our detailed Release Notes—those are still your comprehensive source for all updates. Think of this as a quick companion tool to highlight the most impactful changes when they happen.

And remember, our Online Help Articles are always there when you want to learn more or explore a feature in depth.

Launching soon—another way we’re helping you work smarter with StrataMax!

|

|

|

|

|

|

|

|

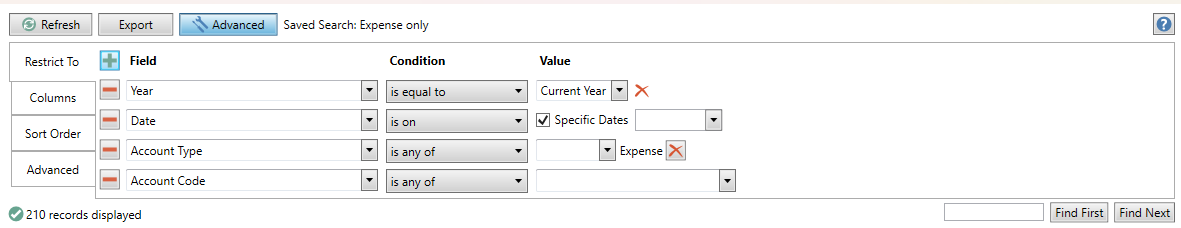

What's Changed | Transaction List

The updated Transaction List feature now provides a cleaner, PDF-style report of all transactions—including journals, receipts, invoices, and payments—across any financial year. Reports are now delivered via the Report Distribution window for consistent delivery

For working with specific account codes or exporting to Excel, we recommend using Local Transactions (per property) or Global Transactions (across all buildings), both of which are faster and more flexible for data extraction. Saving these searches too will provide consistent column display and including fields of restriction like Account Type for expenses and Account Code is any of will provide options for selecting multiple accounts.

Key features include:

- Customisable Settings: Use the cogwheel to adjust sort order, account code ranges, and display of hidden transactions.

- Multi-building Support: Tag multiple properties with the Building Selector Tool.

- Template Options: Choose between (note: letterhead is not supported in these reports):

- Transaction List (gentran)

- Transaction List with GST (gentran1)

- Export efficiently using Local or Global Transactions for faster Excel exports and select particular account codes.

Learn more on the Transaction List Help Page, and visit the Local Transactions Guide for tips on filtering and exporting data.

|

|

|

|

|

|

|

|

Payment Processing Tips

Why should I register for this session?

Get confident with all things payments! This session is designed to give you practical, hands-on knowledge for navigating and managing payment processes smoothly. Whether you're handling regular transactions or troubleshooting payment issues, you’ll walk away with clear, actionable steps to make your workflow more efficient. Topics Covered:

- Payments on Hold: How to identify and and move them off hold when needed.

- Managing Overdrafts effectively.

- Navigating the Invoice Hub with confidence.

- Processing One-Off Payments, Refunds, and Reimbursements.

- Using Searches to track, verify, and troubleshoot payment issues.

Wednesday 21. May 2025 | 11:00 am AEST

|

|

|

|

|

|

|

|

Income Tax Preparation

Why should I register for this session?

June 2025 will be the first opportunity for most of you to setup and use the new and enhanced Income Tax Reporting. Using various reports and searches in StrataMax we can help you identify what accounts may need to be setup so information can then be easily extracted to supply to your lodging tax agent / accountant.

Topics covered:

- Reports / Searches to assist with setup and checking account settings.

- Configuring accounts using Account Maintenance.

- Review of what is reported and how to adjust, delete or finalise.

- Producing reports for Accountants or Tax Agents to use for Lodgement (PDF or Excel).

The session will also cover some specific scenarios, including:

- Plans/Buildings only completing a portion of the tax year on StrataMax – how to manually manage.

- Accrual adjustments for amounts which are not reportable transactions – i.e. Interest not yet received.

Tuesday 27. May 2025 | 11:00 am AEST

|

|

|

|

|

|

|

|

The New "What's New" in StrataMax

Why should I register for this session?

Join us for the last webinar of the month where you'll be shown the "What's New" icon along with the highlights of the past recent updates. With this webinar you will gain a comprehensive understanding of the latest features, and discover new functionalities, which will in turn ensure you maximise the benefits of our continually evolving software suite.

Topics covered:

- The What's New feature in StrataMax.

- DocMax Outlook Add-In enhancements.

- Bank Reconciliation - New validation.

- Search Creditors enhancement.

- Communication enhancement.

Thursday 29. May 2025 | 1:00 pm AEST

|

|

|

|

|

|

|

|

|

|

|

|

|