|

The instructions in this article relate to Income Tax. The icon may be located on your StrataMax Desktop or found using the StrataMax Search. |

Income Tax will assist with setup and reporting of details required to assist with lodgement of the income tax return. The information will be available to be sent as a report or extracted to Excel for a Tax Agent / Accountant to assist with lodgement to the ATO. There is also the option to view the current year to be prepared and reported for handover of a property to another manager.

Income Tax | Security

To access the Income Tax, the user must have permission set to 'Allow' for Income Tax under the 'FinancialReports' category in Security Setup.

Income Tax Setup

Income Tax lodgement requires specific details, for transactions in the July - June tax year, to be totalled and then provided to the authorised lodging person. This information is used to correctly calculate the income tax which can then be lodged and payment processed or refund received.

StrataMax does not assist with the calculation of the amounts for lodgement, but provides the tools to assist with reporting this information.

Correct setup of the specific accounts is required and can be completed in Account Maintenance. The accounts required for reporting will be determined by the transactions that are to be applied to the particular account and your accountant is often the most suitable person to assist with identifying these accounts and ensuring the setup is correct.

The areas that are provided for reporting on the Income Tax Report and Search are noted below:

- Income

- Non-Mutual Income

- Fully Claimable Expenses

- Partially Claimable Expenses

- PAYG Instalments (as reported on the BAS)

The Account Maintenance options available to assist with assigning to the correct tax reporting area:

- Income Accounts - can be set as Non Mutual Income and can also be set as Non Claimable Income which will exclude being totalled in the Income.

- Expense Accounts - can set be set with an Income Tax Expense Category which may be fully or partially claimable.

- Set the Tax File Number (TFN) as this is required for completion of the Income Tax for the selected Building / Plan.

TIP: Locate where TFN's are missing using Search Buildings to select all of the portfolio and add display column TFN then restrict to TFN is empty. This will show all Buildings that will need an update for the TFN field to be completed in Building Information.

Master Chart Report

To assist with the classification of accounts to define the accounts for amending in the setup above, use the Local Accounts in the Master Chart to see the current portfolio setup. Then the Export can be provided to an accountant / tax agent to help with classification.

- Search or select Local Accounts.

- Amend the search:

- Restrict to: Account Type is any of Revenue and Expense (see below for more options).

- Columns: Add - Income Tax Expense Category / Non-Mutual Income / Non-Claimable Income.

- Refresh.

- Export.

This will provide the Master Chart of Accounts and the current classification if any displayed in the added columns.

Income Tax Status

Income tax is designed to report information from each Building / Plan, to use for lodgement of the annual income tax return to the ATO. Once the reporting period has been completed and the information reviewed, this can be reported using Income Tax Report for a combined PDF Report or can be exported into Excel, using Search BAS, which may be easier to use for the person completing the lodgement.

- Search or select Income Tax.

- Select from options:

- Current building: ensures only the Income Tax for the current selected building (noted at the top of the window) are displayed.

- My Buildings (Account Manager): to select an individual Account Manager name and the properties they are listed for.

- Management Office: select from drop down.

- All Buildings: to tag individual or a subset of buildings.

- Select to:

- Show all - all buildings based on above selection.

- Show due only - buildings that are due for review for the income tax year completed but not yet prepared.

- Select 'Prepare to 30/06/**.

- Send the Income Tax Report to accountant / tax agent or use Search Income Tax for alternative Excel option to produce a report to provide to your Tax Agent or Account.

Income Tax Amendments

Amendments to the reported totals in the Income Tax, can be completed by:

- Amending accounts in Account Maintenance.

- By excluding specific transactions on an individual Building / Plan.

- Adding new transactions on an individual Building / Plan, dated in the reporting period.

Global Amendments

Account Maintenance is used to update the reporting for Income Tax with the specific fields as outlined below. These should be reviewed and may be advised to be adjusted by an accountant or tax agent. These steps should also be used when there have been multiple individual transactions updated across the portfolio.

- From either the Master Chart Building or the local building, search or select Account Maintenance.

- From the Account Maintenance window, use the Search field from the Account code list to enter either the description or number of the required account code. Click the pencil icon to edit the selected account.

- Review the tax fields and update accordingly:

- Non-Mutual Income

- Non Claimable Income

- Partly Claimable Expense

- Fully Claimable Expense

- Apply Changes to Master Chart & Buildings should be reviewed and selected if all buildings are to also be updated.

- Click Save, then Close Account Maintenance.

- Search or select Income Tax.

- Select either

- 'Delete and prepare to 30/06/20**' if the Income Tax was already prepared prior to the above amendments, or

- 'Prepare to 30/06/20**' if the period has not be prepared already.

- Send Income Tax Report to accountant / tax agent or use Search Income Tax for alternative Excel option.

Individual Amendments

Adding or removing specific transactions can be completed to an individual Building. These updates can then be applied and reports issued. If adjustments are made to multiple Buildings, use the Global Amendment instructions to update the complete portfolio if required.

Add Specific Transactions to Income Tax Reporting

After the reporting period is complete, transactions may still be added, updated and re-reported. This may occur when information is not always available prior to the end of the Tax Year. i.e. Interest amounts to be included.

Add the required transactions / journals / adjustments to the select Building/s, ensure that the date is within the reporting period - i.e. Interest Income (Non-Mutual) for 30/06/20**.

Example

- Search or select Income Tax, then choose the required display settings.

- Locate the Building / Plan for adjustment.

- Select the appropriate action:

- Edit Latest Income Tax Period, selecting 'Yes' to update with any new transactions if there have been changes.

- Prepare a New Income Tax Period, if this has not yet been done for the current period.

- Select the blue info icon in the top summary section to show the related accounts and totals.

- Select the Account where the adjustment was applied (either Income or Non-Mutual Income in example above) to confirm is now correct.

- Select Finalise once all amounts are as expected.

NOTE: The Print option is available, for the selected Building, to produce the Income Tax report.

Delete Specific Transactions from Income Tax Reporting

- Search or select Income Tax, then choose the required display settings.

- Locate the Building / Plan for adjustment.

- Select the appropriate action:

- View latest Income Tax Period (a view of the last completed period).

- Edit Latest Income Tax Period, selecting Yes to update with any new transactions if there have been changes.

- Prepare a New Income Tax Period, if this has not yet been done for the current period.

- Select the appropriate action:

- Select the blue info icon in the top summary section to show the related accounts and totals.

- Select the Account for adjustment.

- In the bottom section, use the 'X' to delete the appropriate transactions.

- Select 'Yes' to confirm to remove the transaction, repeat if required.

- Select Finalise once all adjustments are complete.

NOTE: The Print option is available, for the selected Building, to produce the Income Tax report.

Delete a Specific Income Tax Report

If transactions are excluded by mistake, the income tax may be deleted and then re-prepared to re-set all the totals and transactions for the reporting period.

- Search or select Income Tax, then choose the required display settings. Locate the Building / Plan for adjustment.

- Select the appropriate action (either option will offer the delete):

- View latest Income Tax Period (a view of the last completed period).

- Edit Latest Income Tax Period, selecting Yes to update with any new transactions if there have been changes.

- Select the appropriate action (either option will offer the delete):

- Check the correct Building and period are displayed, then select 'Delete', click 'Yes' to 'Are you sure you want to delete this Income Tax Report' which will close and return to the Income Tax Status screen.

- Select 'Prepare a New Income Tax Period' to refresh all the details and include all transactions for the period.

- Review and finalise to complete.

Manual / Incomplete Income Tax Reporting

Not all Buildings / Plans may provide the required information for the complete tax year. This is due to the information on StrataMax only being available for a portion of the current tax year. This often occurs when a new setup is completed and opening balances include/exclude details that may have to be manually collated from a prior manager/software records. For instructions on how to use Local Transactions, which will allow the data for transactions created for periods available in StrataMax, see here.

Examples:

- Building Financial Year: Jan 2024–Dec 2024, Tax Year: July 2023 – June 2024

Building installed with opening balances in Jan 2024. Problem: Data for July – Dec 2023 is not available in StrataMax, extra reports will be required. - Building Financial Year: May 2023–Apr 2024, Tax Year: July 2023 June 2024

Building installed March 2024 with opening balances – i.e. opening balance journal would cover period May 2023 – March 2024. Tax year report would cover July 2023 – June 2024, including opening balance, so may need to exclude opening balances from Income Tax and provide extra reports. - Building installed without profit and loss figures from prior manager.

No data for period not installed in StrataMax. Two reports will need to be combined for tax year reporting.

Bank Reconciliation Summary Report

This report may also be used to clarify the Cash at Bank at a point in time for all bank accounts, including investment accounts. Review the article for Bank Rec Summary Report.

Tax Year Balance Sheet

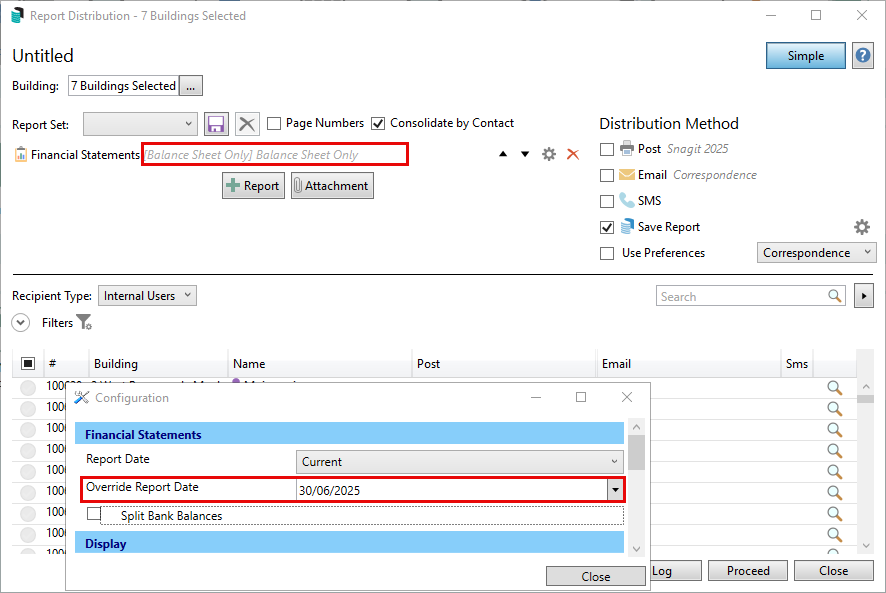

Using Report Distribution, the Financial Statements can be produced using an 'override report date'. This allows the Balance Sheet template, to be selected, to reflect figures as at 30 June. This report may be supplied alongside the Income Tax Report to verify the Balance Sheet totals.

NOTE: If Income and Expenditure reports are included, they will display data from the start of the building’s financial year. These figures should not be used for income tax calculations. For accurate tax reporting, please follow the Income Tax instructions provided above.

- Search or select Report Set, then select Financial Statements.

- Select the configuration cogwheel to:

- Enter the Override Report Date (30/06/**).

- Amend the template to Balance Sheet Only.

- Click Close.

- Use the Building selector to tag the required Buildings.

- Select Save Report (only) to save each report to DocMax.

- Select the cogwheel to apply a DocMax profile.

- Select Proceed, to view onscreen.

- Select Proceed to save a copy to each Building in DocMax with the selected profile.

NOTE: If the reports are required to be sent externally to a tax agent / accountant, this can be done from DocMax with the use of Export Documents. This export could also be inclusive of the Income Tax Report if also in DocMax.