|

|

This menu is used exclusively to set up a new building in your portfolio. It cannot be completed until the owner details have been entered into the Roll screen. For the entire process, refer to the Create A New Building article.

Opening Balance Setup cannot be used if it has been processed previously. Any attempt to do so will display the following warning:

Similarly, if transactions exist in the ledger with the descriptions 'Opening Balance' or 'Brought Forward', the Opening Balance Setup screen fields will be unresponsive. This is designed to help prevent opening balances from being entered and processed twice.

If this is the case, Journal Preparation can still be used as an alternative. However, it is a lot more complex and will only allow for the creation of transactions for the current year. If the opening balance is from the bank deposit, the description can be edit to 'transfer' or 'opening deposit' using Local Transactions.

It is still recommended that the Opening Balance Setup screen be used to enter the opening balances for a new building before any other transactions are processed. These are just a few examples, but if uncertain, please get in touch with our StrataMax Support Team:

- Entering and saving Receipts.

- This includes the funds transfer from the previous management company, which is processed via the Bank Reconciliation menu.

- Generating levies (entering them in Levy Management and striking them is OK).

- Entering and saving Creditor Invoices.

- Entering Invoices.

- Processing Management Fees.

Opening Balance Setup Features

- A simplified method of entering balances for the Current and Old Financial Years, including the Budget.

- Closing balances and creation of the prior (old) year.

- Real-time view of amounts entered to ensure that balancing amounts are entered.

- Highlighting each line being entered for ease of data entry and minimising errors.

- Easy entry of lot balances by each fund.

- Levy generation of levies already issued and due for the current year can be generated to allow for accurate reporting and arrears processing.

- Add new accounts.

- Calculation and processing of funds for system accounts.

- Save the balances for others to review or later process.

- Creates an Unpresented Receipt for Cash at Bank on the Bank Reconciliation pending the initial deposit.

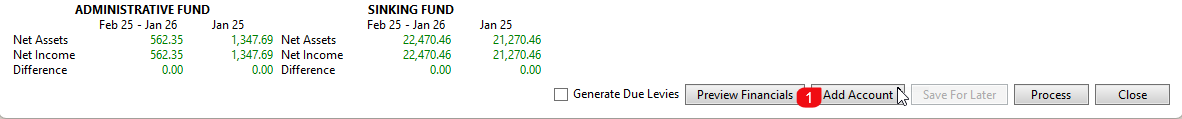

- Preview Financials, including Lot Balances, before processing and creating transactions.

Handover Financial Reports

When entering the opening balances, the handover financial statements from the previous management company will be required. The financial reports should be checked to ensure that they are in balance. If the report doesn't balance, the previous management company will need to be consulted, otherwise it is recommended that qualified accountant be engaged. The reports will need to include:

- Income & Expenditure / Profit & Loss.

- Balance Sheet.

- Lot Positions / Debtor Balances total the same amount as the Levy Arrears or Advance figures on the Balance Sheet.

- Details for Balance Sheet accounts: Other Debtors, GST Reports, Unpaid Creditors, Bank Statements, etc.

- All the same reports from the prior financial year if they also need to be entered.

Prior year financials can be entered using the Opening Balance screen and completed later. However, each fund's closing balances MUST match the Current Year's Opening Balance to process.

Before entering Opening Balances

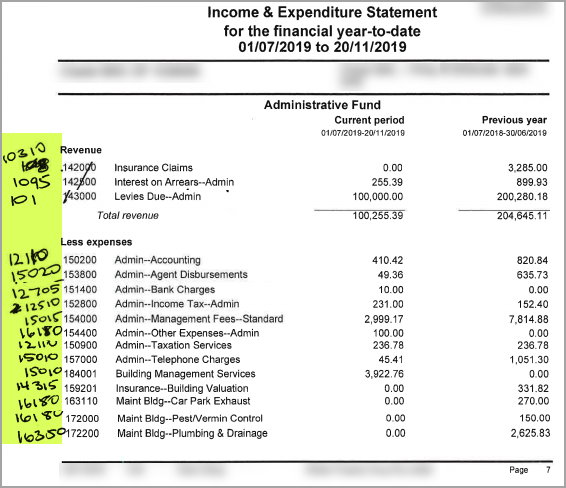

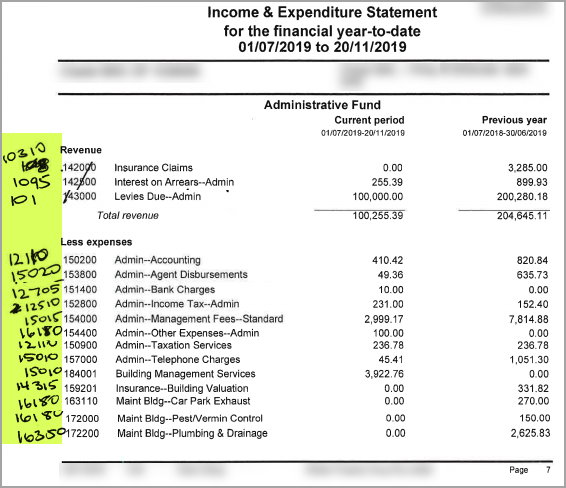

To make the process quicker and easier, it is recommended that the financial statements be reviewed and the accounts pre-coded with the intended account codes. This will ensure fast data entry and remove the requirement to add accounts during the data entry process. It is also recommended that the Process Date in the Opening Balance screen be the same date as the handover financials.

- Review and mark the Income & Expenditure (Profit & Loss) statement and the Balance Sheet (if there are a few) on the handover financials with existing account codes in Account Maintenance.

- If an account code is missing, use the Add Account to either add it from the Master Chart or create a new account code.

Using Opening Balance Setup

Open the Opening Balance Setup screen by searching for it or clicking the menu icon in the StrataMax icon (top left) > Property Info > Property Setup.

You should enter the bank balances into the '012 Cash At Bank' fields last. Please refer to the Cash At Bank section below.

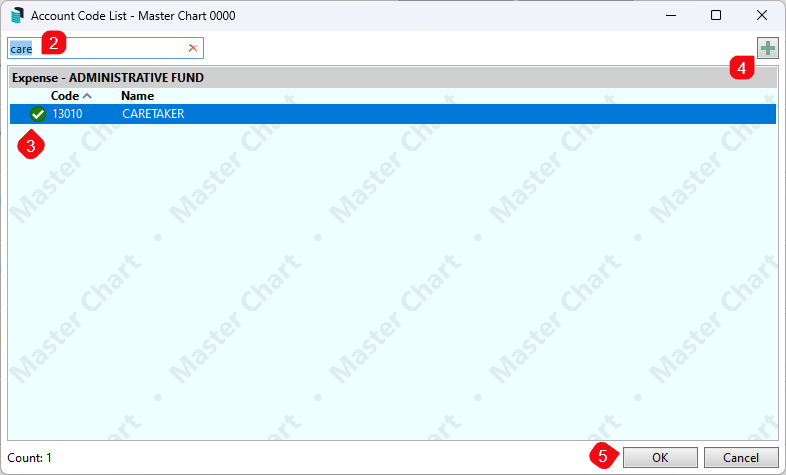

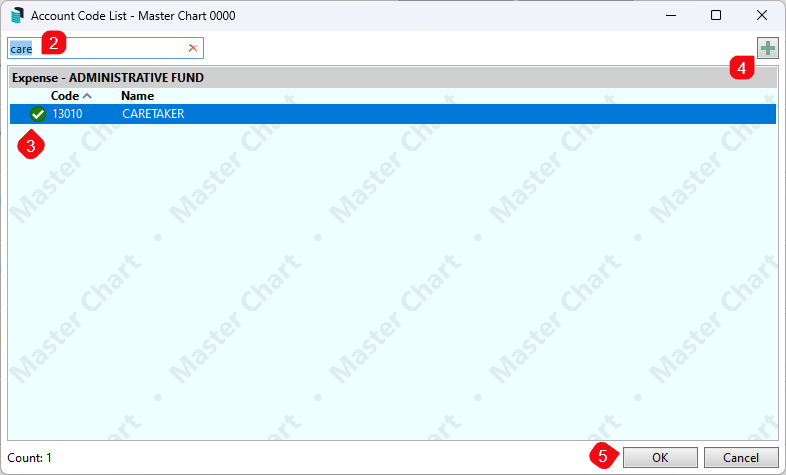

Add Account (Button)

If an account code is required but unavailable when entering the balances (although it is recommended that all the necessary account codes are added before you start entering the figures). In that case, you can add it directly from within the Opening Balance Setup menu, provided it exists in the building's local chart of accounts.

- Click the Add Account button located at the bottom of the menu.

- When the 'Account Code List' window appears, search for the account code by typing the code number or part of the account code name into the search field in the top left.

- Tag the account to add.

- If the required account code does not exist, click the + button to add a new code.

- Click the OK button, and the account code will appear on the Opening Balance Setup screen.

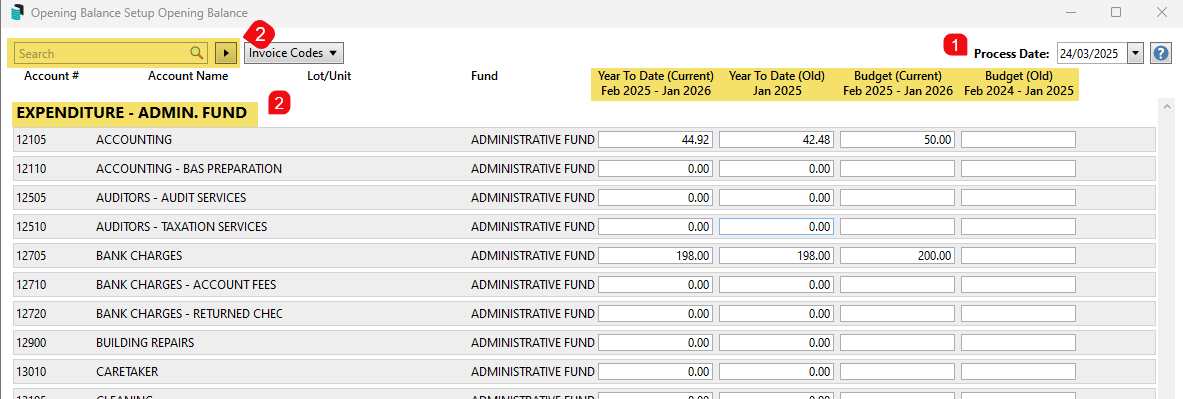

Entering Income and Expenditure (both funds)

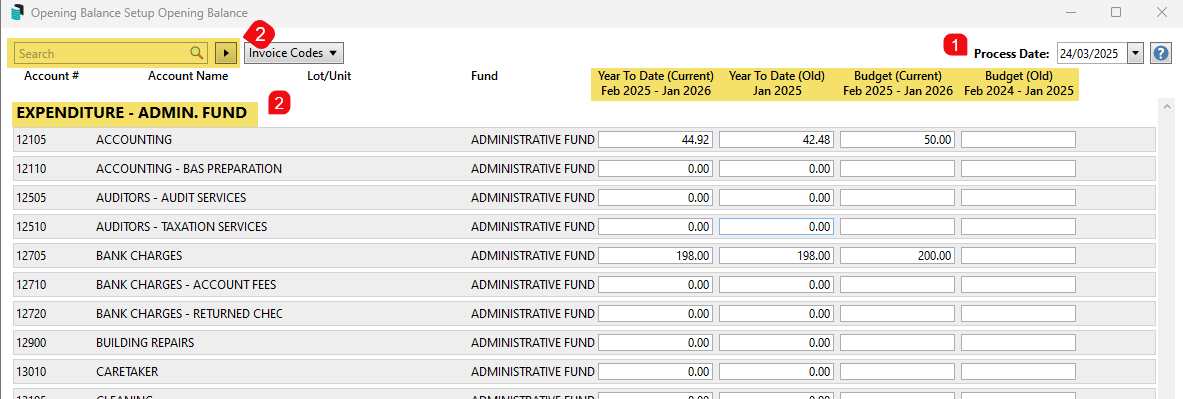

Referring to the handover financials, all funds will be entered using one screen, and the budget information can also be included. The instructions below refer to the Current Year; enter these figures into the (Old) columns if an Old Year is required.

- Check the handover date of the financial statements to be entered and adjust the Process Date to match.

- Scroll to the Administrative Fund section. Enter the Income into the Year to Date (Current) column. Enter the Budget (Current) if desired OR use the top search and enter the account name to refine the list. The results will filter to the top of the list.

- Enter all Expense items per the handover financials into the Year to Date (Current) column. Enter the Budget (Current) if desired.

- Enter the Opening Admin. Balance into the Year to Date (Current) column. The total Administrative Fund Balance should match the balance sheet item for the handover of Administrative Owners Funds.

- Repeat for the Sinking Fund section. Enter the Income into the Year to Date (Current) column. Enter the Budget (Current) if desired.

- Enter all Expense items per the handover funds into the Year to Date (Current) column. Enter the Budget (Current) if desired.

- Enter the Opening Sinking Fund Balance into the Year to Date (Current) column. The total Sinking Fund Balance should match the balance sheet item for the handover of Sinking Owners Funds.

Entering the Balance Sheet incl. Lot Balances

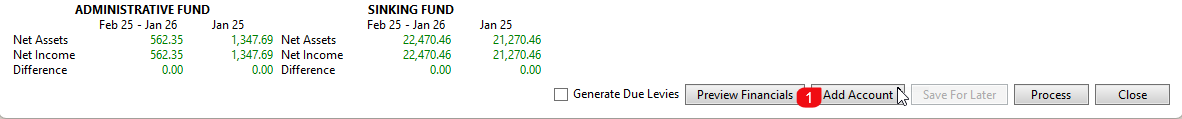

The balance sheet contains a single data entry screen for all funds and includes separate columns for each available fund to be entered. For any Debtor/ Lot Balances, the Administrative and Sinking fund invoice codes are included by default and can be set to include more if needed.

- Scroll up in the Opening Balance Setup window to start the entry for the Balance Sheet items.

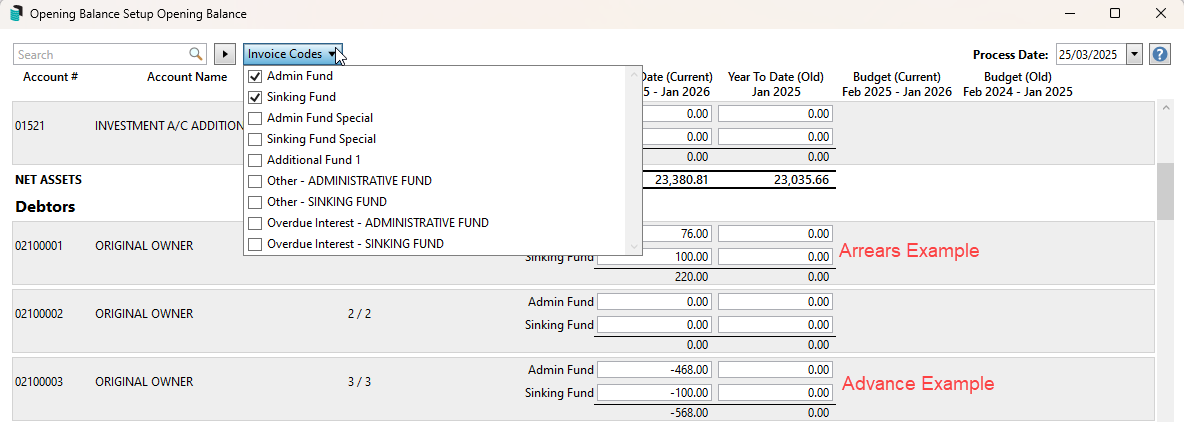

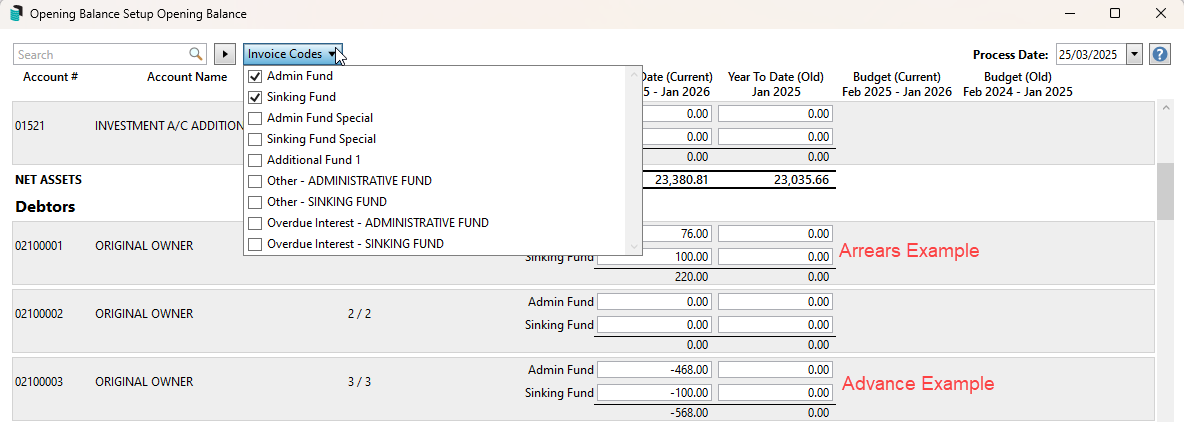

- If further invoice codes are required for the Debtors/ Lot Balances, click the Invoice Codes drop-down selection in the top left and tick the required ones.

- Referring to the handover Debtor/ Lot Balances report, enter each balance into their respective funds. Enter any account in arrears as a whole number, and enter any lots with credit balances using the—symbol.

- After entering each lot, scroll to the bottom and check the totals for Arrears and Advance. These should total the handover Balance Sheet amounts/ Debtor/Lot Balances Report.

- Enter any other Balance Sheet items, finishing with 012 Cash at Bank.

For any outstanding GST amount, it is recommended to create/use a different account code with the number 061004 called GST Conversion Account (or similar) and enter the figure there. This amount should be reconciled with the prior GST reports (software/manager) and balanced to nil with a Creditor Invoice / Credit Note with the lodgement of the first period BAS.

It should not be entered in the 061000 GST Clearing Account, as this is a system account used to accumulate GST and calculate and save the Business Activity Statement(BAS).

- Click Preview Financials to view a copy of the draft financials, including the lot balances report. This is useful if someone needs to check the information before processing.

Processing Opening Balance Setup

Before processing, always complete a Data Storage. Refer to our Data Storage article.

- Click the Save For Later button

- Close the Opening Balance Setup menu.

- Complete the Data Storage.

- Open the Opening Balance Setup menu and click the Process button.

The process will complete the following steps:

- Old Year (if entered) will be created, and transactions will be processed in the general ledger.

- Current Year transactions will be written in the general ledger to balance the amount entered.

- If the Generate Due Levies box is ticked, levies will be generated for all entered periods past their due date.

- Adjustment transactions will be processed to balance the lot/debtor accounts between the old and current year with a balancing entry, leaving the current year balance as the overall balance for the lot/debtor.

If processing the Old Year independently to the Current Year, the Process Date in Opening Balance Setup will need to be edited to a date different to the original Process Date.

012 Cash at Bank

Each of the fund's 012 Cash At Bank fields should be left until all other figures are entered. The figure on the handover financials should also match the expected funds, which the previous management company either transfers by EFT or issues to you as a cheque. An unpresented receipt to the '012 Cash At Bank' account code will remain on the Bank Reconciliation pending the initial deposit, which will be presented to this transaction.

If the figures are different, then it's possible that deposits or withdrawals occurred after the previous management company produced the handover financials. If this is the case, they should be engaged to provide details on any transactions so that adjustments can be made after the opening balances have been processed. When the initial deposit downloads, these adjustments are created in Journal Preparation or the Bank Reconciliation screen using the Add Allocation function.

Opening Balance Deposit Form (cheque)

Once the Opening Balance Setup screen has been processed and bank account details are loaded into the Bank Account Setup, a deposit form can be printed for the 012 Cash at Bank account. Once the funds have cleared into the bank account, the deposit form will automatically process the cheque in the Bank Reconciliation screen.

Refer to our Print Deposit Forms article for guidance on deposit forms.

Opening Balance Bank Reconciliation (New Buildings)

If the bank account funds balance was entered in account code '012 CASH AT BANK' during the Opening Balance Setup process and a deposit form was not created to deposit the funds, please follow the below steps when the initial deposit appears in the Bank Reconciliation screen.

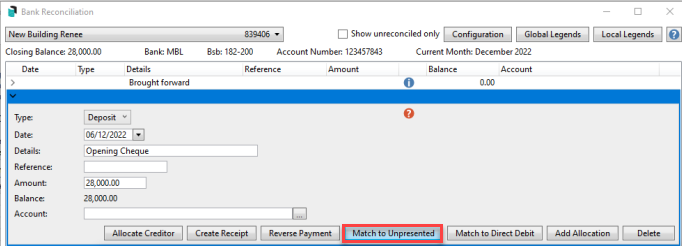

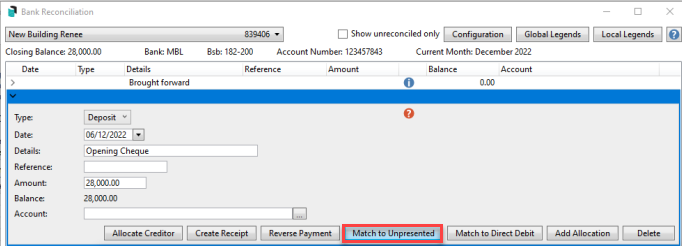

- Search or select Bank Reconciliation.

- Highlight the opening balance transaction to expand the transaction information.

- Do not enter anything in the Account: field and simply click the Match to Unpresented button.

- Tick the Receipt in the 'Select Unpresented' window.

- Note that you must also tag the account code (most likely '011' or '012') before proceeding.

- Click Auto Reprocess once all transactions have been allocated as required.

- If the Bank Reconciliation is not reconciled, it is recommended that you view the Bank Reconciliation Report and the Local Transactions for account '012 CASH AT BANK' to begin the Reconciliation process.

Opening Balance Transferred Buildings

Before proceeding with reconciling the bank funds for a transferred building, you should check the Interactive Reports to confirm which general ledger account code contains the funds as they can either be in '011 CASH ON HAND' or '012 CASH AT BANK'.

If the bank funds report on the '011 CASH ON HAND' account, then in the Bank Reconciliation screen, simply post to that account and click Auto Process.

If however, the bank funds report on '012 CASH AT BANK', then follow the below steps to match the funds transfer.

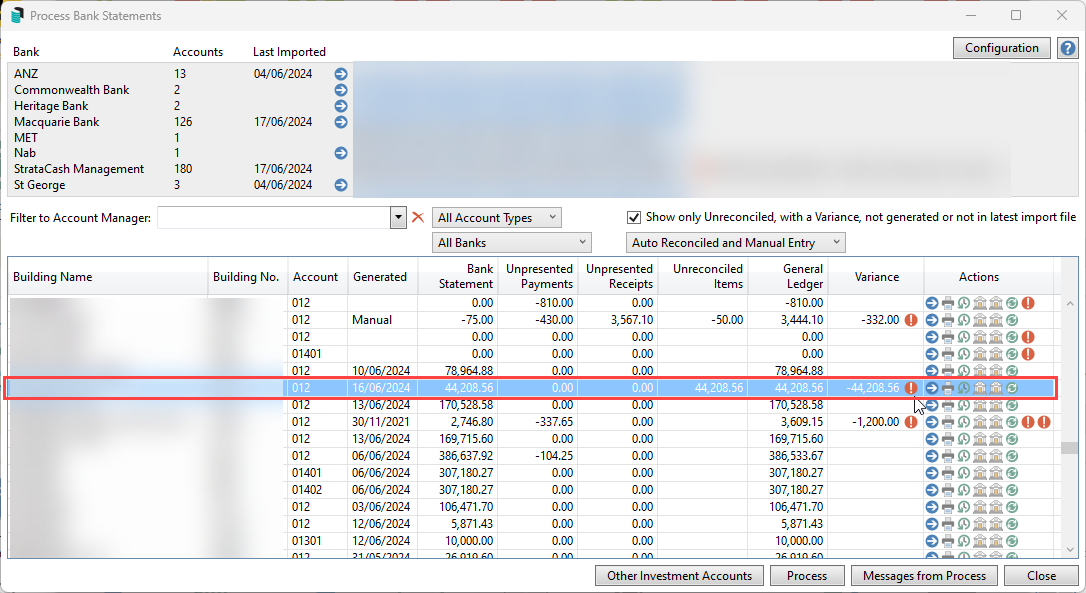

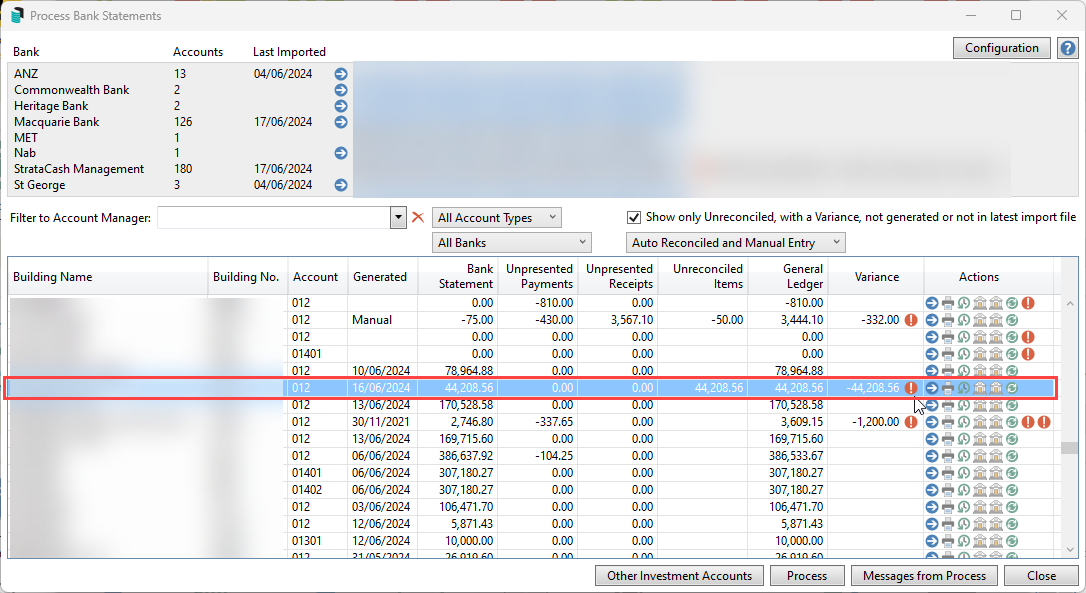

- Search or select Process Bank Statements.

- Locate the new building, where there will be a figure under the 'Variance' column, along with a red round warning icon.

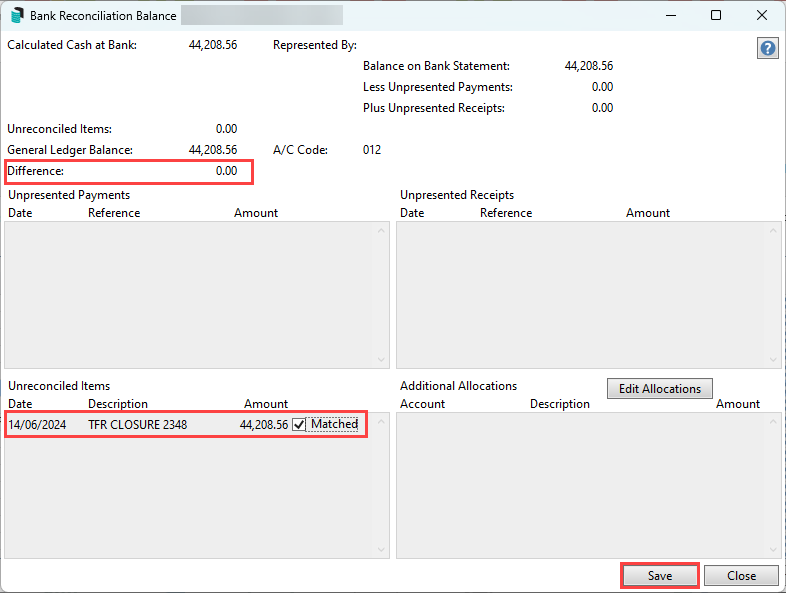

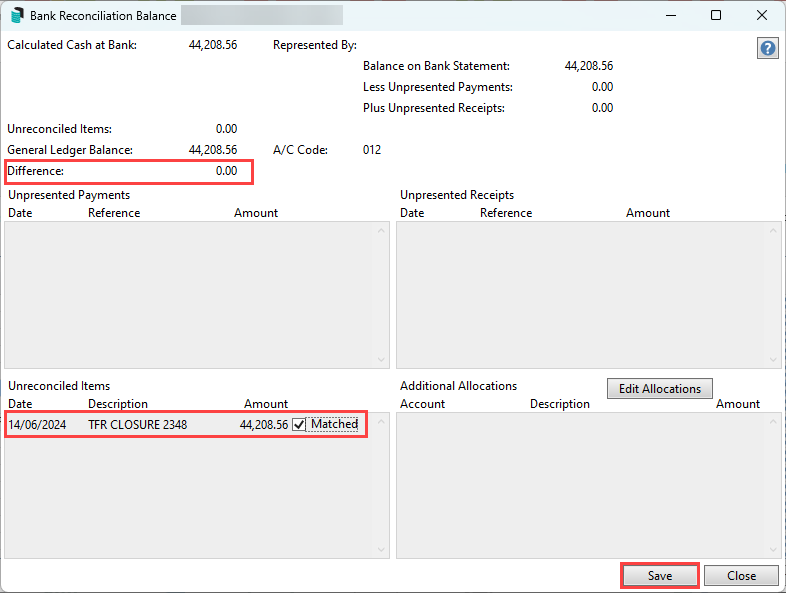

- Click the red warning icon and the 'Bank Reconciliation Balance' window will open. Under the 'Unreconciled items' section in the bottom left, tick the Matched box, and the 'Difference' figure should change to '0.00', and you can click Save.

Generate Due Levies

If the prior manager has issued levies for the current financial year and the due dates have passed for one or more of these, these can be generated based on the struck levies entered into Levy Management.

It is recommended that the levies be entered, struck, and generated in Levy Management, as this method does not allow for edits to be applied if they are generated using this setting.

Additional fields under new headers called 'Levy Balance' and 'Levy Amount' will appear under the Lot Balances section by ticking the Generate Due Levies box. These are where adjustments should be made to ensure the lot balance matches the handover financial reports after the levies are generated.