| The instructions in this article relate to Income Tax Report. The icon may be located on your StrataMax Desktop or found using the StrataMax Search. |

Income Tax Report will assist with reporting Income Tax for a single building, across your portfolio or by manager or management office. The information reported is to be used to assist with the lodgement of the income tax return. The period reported will the be for the 'prepared' period completed in Income Tax. Send the Income Tax Report to accountant / tax agent or use Search Income Tax for alternative Excel option to produce a report to provide to your Tax Agent or Account.

This is for reporting purposes only, no calculation of income tax is completed by StrataMax.

Income Tax Report | Security

To access the Income Tax Report, the user must have permission set to 'Allow' for Income Tax Report under the 'FinancialReports' category in Security Setup.

Income Tax Report

Income Tax Report will produce the PDF report for distribution to your accountant or tax agent for the buildings you manage to assist with lodgement.

The accuracy of the report will be reliant on the setup being completed for accounts that are related to income tax in Account Maintenance - please refer to the Income Tax article for more information. The report will be incomplete if this initial setup has not been completed first.

It will report:

- Income (All income less not reportable income).

- Non Mutual Income.

- Partly & Fully Claimable Expenses.

- PAYG Instalments (from saved BAS reports for the tax year).

Income Tax Report Old (All Income and Expenses)

The new Income Tax setup and reporting allows more specific and accurate reporting. It eliminates over reporting information that is not used by tax professionals in the calculation of Income Tax. It is recommended that you liaise with your tax agent to setup the account.

All old Income Tax reporting has been removed. To provide a full report of all Tax Year Transactions, the below Local Transactions Search can be setup, then used to report an expanded view of tax year transactions. Using the Income Tax process is still vital in completing the tax year and recording transactions as already included in a tax return.

Income and Expenses | Tax Year

Once you have created the below search in Local Transactions, you can save the Search with an appropriate name and make available to users as required.

The 'Amount' column reports the gross amount, so GST may need to be considered in calculations. The date range can be updated to the appropriate reporting period required.

Restrict To:

Report all Income (Revenue) and Expenses for a selected period with the inclusion of specific tax fields.

Columns:

- Building Name

- Building Number

- Batch No

- Date

- Account Code

- Account Description

- Description

- Reference

- Amount

- GST

- Tax Code

- Running Balance

- Income Tax Expense Category

- Is Non-Mutual Income

- Extra Details

- Is Non Claimable Income

- Extra Text

- Fund Name

- Posting Period

- Account Type

- Income Tax Report Start Date

Sort Order:

The above will sort into Revenue then Expenses. Then by account code and then entry (ID) order.

Advanced:

Distribute the finalised Income Tax Report

The Income Tax Report will be distributed using the Report Distribution screen once it has been prepared and finalised using the Income Tax. The following instructions include how to save a copy to DocMax for each building, as well as how to generate a single report for external distribution.

Distribute the Income Tax Report in a single report

- Search or select Income Tax Report.

- Select the cogwheel to set the 'Income Tax Report' settings.

- To include buildings that only have non-mutual income, tick Only Include Where There is Non-Mutual Income.

- Filter Buildings should be set to All Active Buildings.

- Click Close.

- Click 'Proceed' to preview the report, which will include a single file. Use the Save icon and save the file to a network location. Or use the Email icon to send via email.

Distribute the Income Tax Report individually for DocMax

- Search or select Income Tax Report.

- Select the cogwheel to set the 'Income Tax Report' settings.

- To include buildings that only have non-mutual income, tick Only Include Where There is Non-Mutual Income.

- Filter Buildings should be set to Selected Buildings (separate report per building).

- Click Close.

- Use the Save Report area and set / check the profile.

- Use the Building Selector Tool and tag buildings.

- Click 'Proceed' to preview the report, and then click 'Proceed' again from the preview window to save each building's report to DocMax.

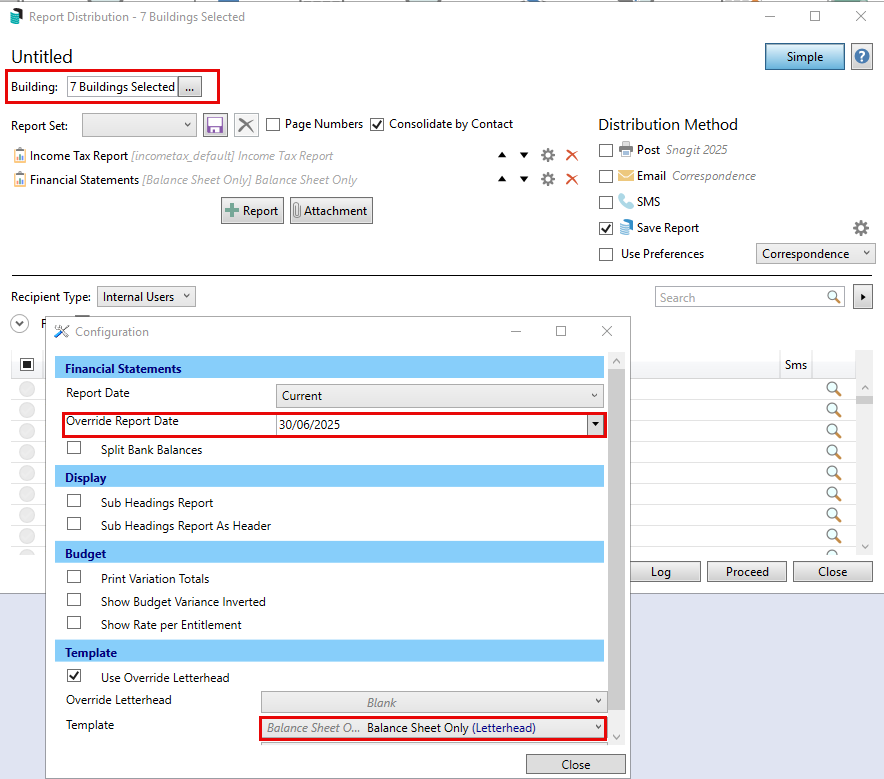

NOTE: Enhance the reporting by adding the Financial Statements - Balance Sheet only with an Override Report Date to 30 June. This will create a report for each Building with both reports and will be saved in DocMax. Export Documents can then be used to provide for use for lodgement.