|

Please note that the Transaction Code Change icon and menu are for StrataMax versions 5.6.109 and below. For StrataMax versions 5.6.110 and above, please refer to Global Transactions | Change Transaction Code and Local Transactions | Change Transaction Code.

Transaction Code Change can be used to move individual transactions from one Income or Expense account code to another. If the two account codes (transfer from and to) are within the same Fund or Account Group, most transaction types may use this process. Account codes that are setup to report as either Main or Sub-Accounts may not be transferred between each account type, using this process, journals are recommended.

If the two account codes (transfer from and to) are for different funds or account groups within a property, only expense transactions that have been created via the Creditor Invoices menu will be able to use this process. Creditor Invoice transactions are identifiable by a ‘D’ reference. This may exclude some transactions such as TaskMax services fees from using Transaction Code Change to move between funds.

If account codes within the Balance Sheet code ranges need to be corrected, this can be done using Journal Preparation, however take extreme care as Balance Sheet account codes are often totaling accounts and adjustments should be done within the Income and Expense Code ranges instead.

Other types of transactions that may have previously been able to use the Transaction Code Change process and are required to be changed between funds or account groups should now be rectified using Journal Preparation.

If you have taken over a property from another manager, local account codes may exist for the building, the process to amalgamate the local codes to your master chart of accounts is required. This is done using Change Code Number, which will change all transactions to a new code.

Transaction Code Change

- Search or select Transaction Change Code.

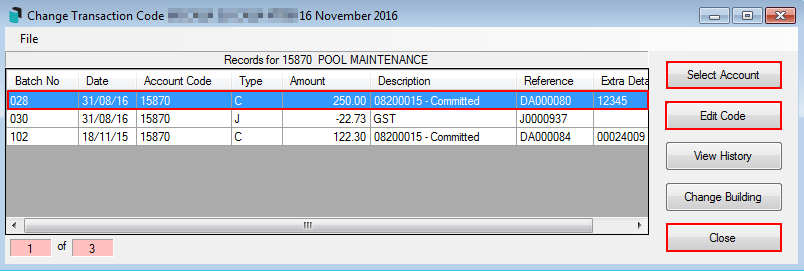

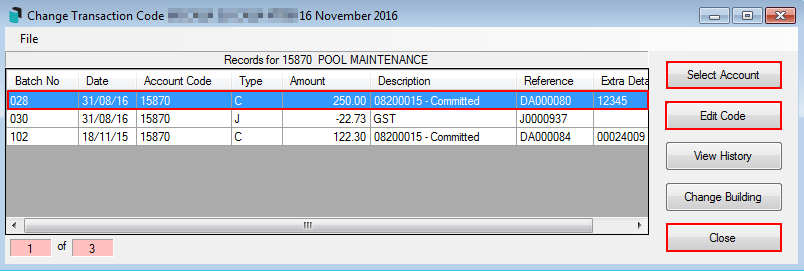

- Click Select Account to select the expense code that requires changing.

- Click Edit Code to select the new requested expense code to be moved to.

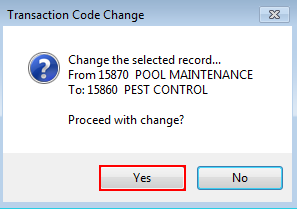

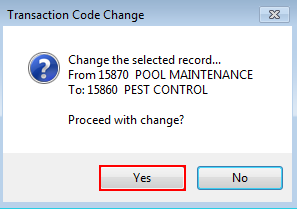

- When prompted to confirm the change code from XXX account to XXX account, select Yes.

- Click Close.

GST transactions will automatically move the GST transaction to the appropriate expense code. You may wish to hide the original GST and reversal GST entry to stop this reporting on the Transaction List or the popular Account Summary report which is available in the financial statement window as a Report Setting additional report. This can be done using Transaction Report Manager.

Add / Change a General Ledger Code

You can add or change a general ledger code within Transaction Code Change.

- Select the File menu and select Add/Change General Code.

- Click Add From Master Chart to select an account code from the Master Chart list and select OK once located OR

- Click Add New to create a new account code.

- Click Close and proceed to complete the Transaction Change Code process as outlined above.

View Log

You can view a log of all changes that have happened in a building when using Transaction Code Change:

- Click on the File and select View Log.

- The log of code changes will be displayed.