|

|

When registered for GST, transactions created will use the account code tax setting to determine if GST is applicable. GST transactions will be created when the tax code is set for GST. Where the original transaction/s created needs adjustment to include / exclude GST, GST Balance Adjustments can be used to amend as required.

Adjustments to existing transactions must be reviewed to determine if only required for a transaction or if an amendment to the account code tax setting should be completed.Timing for a tax setting to be amended will be determined if the account code/s is changing from a GST Account to an Non-GST Account.

The Business Activity Statement for the current period (based on current month) will be the period when GST adjustments will be reported. However, if the original transaction was in a prior period, financial reporting for the GST will be in the reporting period based on date.

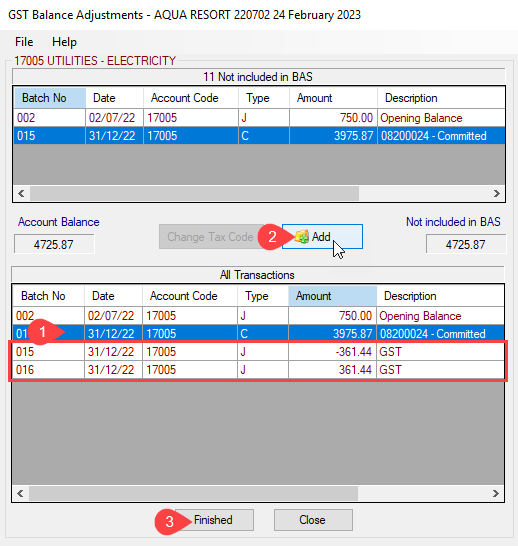

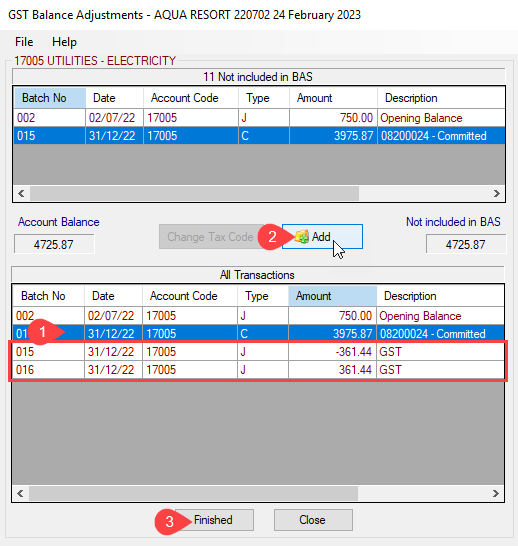

Add GST to a transaction

For any transactions that should have GST calculated however, did not have on the original transaction, follow the steps below to apply GST to the transaction.

- Search or select GST Balances Adjustments.

- From the preview window, select 'Show Accounts which have amounts in no GST'.

- Highlight the account code to be amended click Select to to show all associated transactions.

- Review the transactions at the top of the screen, that are not included in the BAS, highlight the entry GST should be calculated on.

- Select Delete to remove transaction from Not included in BAS section add the GST will then calculate in the All Transactions section.

- Once all required transactions have been amended click Finished to exit the selected account code.

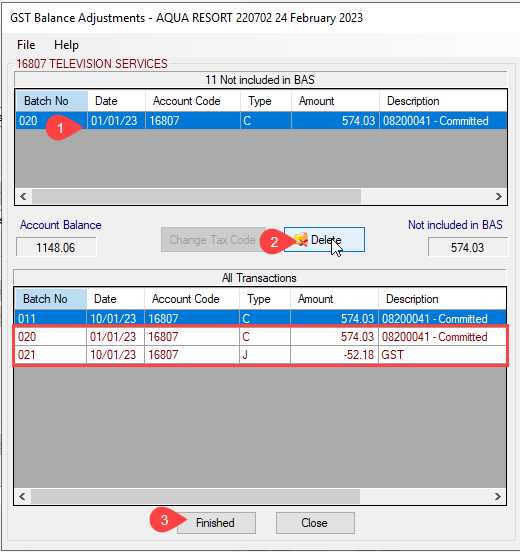

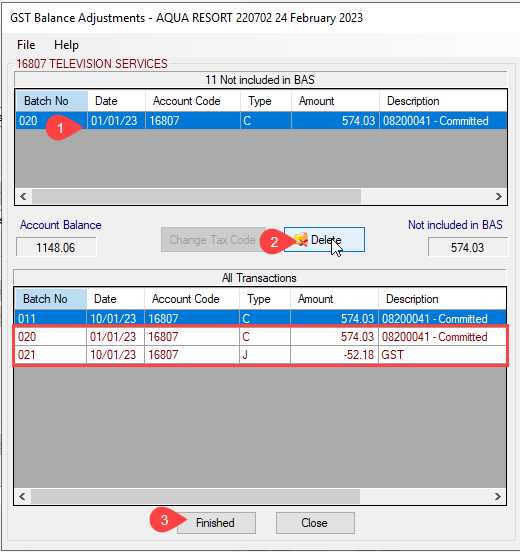

Remove GST from a transaction

For any transactions that have calculated GST however should not have included GST, follow the below steps to remove the GST from the transaction.

- Search or select GST Balances Adjustments.

- Click Select on the relevant account code to show all transactions.

- From the GST Balance Adjustments window review the table of transactions in the top half, which includes transactions that are not included in the BAS (have no GST). Select the transaction that has been set to be Not included in the BAS.

- Click Add.

- Confirm the GST transaction has been created (repeat if more transactions to the same account should be adjusted)

- Click Finished once complete.

Repeat the above process if required for additional account codes.

Change a Tax Code with Existing Transactions

Often a review of the accounts with an audit, or BAS reconciliation, may identify where an account code is setup incorrectly. This process will assist to correctly apply changes to an existing account where the Tax code setting is incorrect, as well as completing a Master Chart Filter to update the portfolio.

The change of Tax code will only take affect for future transactions.

Confirm if the Master Chart has the same tax setting for the same account or if just a local building fix.

After identifying the account code that is incorrect follow the steps below to determine which scenario should be followed:

- Complete a Data Storage, then lock the building.

- In Account Maintenance review current Tax code field.

- Tax code '00' will be calculating GST on transactions, any other tax code will not be calculating GST.

Select which scenario below you are trying to achieve and follow the steps;

Amend Account code currently set for GST

When an account code has incorrectly calculated GST on transactions, the prior transactions and GST must be corrected prior to the adjustment of the tax code. Once complete, the Tax code can be amended for all future transactions.

Setting the Tax code to another setting before correcting GST transactions will result in manual journals requiring completion. See below for correct format.

If the financial year is recently completed, this process may be required to be completed in the Old Year and repeated in the current year.

- Follow the above instructions to Remove GST from a transaction, ensuring to remove GST from all transactions for the selected incorrect account

- Reports / Transaction List - tag and review the transactions on the account code / GST Clearing Account or Gross GST accounts if applicable. Confirm that there is no-longer any GST calculated on the account code.

- Repeat for all buildings.

- Once the buildings are correct and GST has been removed continue to update the Tax Code.

Master Chart | Update Tax Code

- To access the Master Chart building, in the building selector tool, click on the Select Master Chart building.

- Then search or select Account Maintenance and follow the instructions to amend the tax code, check with your accountant on the applicable tax code setting if unsure.

- Ensure the 'Apply Changes to Master Chart & Buildings' box is ticked.

- Click Save.

Amend Account code currently not set for GST

If the account identified is already set to not calculate GST, you must first complete the steps above in Master Chart | Update Tax Code. All existing transactions will already be excluded from GST calculations. If some of the existing transactions, for the account code, are required to have GST Calculated, follow the steps above to Add GST to a transaction and repeat as required for all transactions in the account code and then all buildings in the portfolio.

Manual adjustment for removal of GST - after tax code update

If the adjustment to the tax code has been completed BEFORE correctly removing the GST from an account, a journal must be completed in the correct format to remove the GST component. Amending a tax code to not calculate GST will set all transactions as 'No GST'.

Example: Details must correctly reflect the GST **** so that the amount is correctly reflected in the current period BAS.