| The instructions in this article relate to Levy Invoice Code Setup. The icon may be located on your StrataMax Desktop or found using the StrataMax Search. |

Levy Invoice Code Setup is where the levy invoice codes are created, edited and deleted. These codes are used by the levy funds and other income codes to charge lot accounts. For example, all buildings will have an Administration Fund for recurring expenses, and a Sinking Fund (or Capital Works, Maintenance, or Reserve Funds), which is primarily used for anticipated future major expenses as per their Sinking Fund Forecast (e.g. roof replacement, building painting, etc.).

By utilising the features in StrataMax, all levies and other charges can be made to each lot account clearly and simply. Some of the areas that are controlled here include Levy Type, Levy Description, Levy Discount, Levy Instalments, Income Account, Discount Account, Posting Priority, Sort Order, Advance and Arrears Reporting, and Interest Options as well as Levy Instalments. There is availability for 15 Levy Invoice Codes as Certificate balance fields can be used once only.

Levy Invoice Codes are set up locally for each building with the Base Building used to control what the Levy Invoice Codes would be set for a newly created plan. Security settings can be updated to restrict access to this area. All changes to the Levy Invoice Codes are recorded in the system logs.

Levy Invoice Code Setup Overview

Used  (1)

(1)

Indicates if invoice code has been used. If an Invoice Code has been used, it cannot be deleted until it has not been used in the current and in the old years. There are also invoice codes that are mandatory and cannot be deleted. These are '01 Administrative Fund', '05 Administrative Fund Special', '07 Sinking Fund', '11 Sinking Fund Special', '18 Other' and '17 Overdue Interest'.

Invoice Code (2)

This is simply a number for each levy fund. This must be unique within a building, but this number can be added across other buildings if required to maintain consistency, if the same levy fund is used in multiple buildings.

Income Account (3)

The general ledger account code that is used for the transaction, when levies or invoices are created. This must be a unique number for each Invoice Code.

Levy Description (4)

The name of the levy. This appears on various reports and menus such as Levy Management, Levy Notice/Reports, and Arrears Notice.

Certificate (Balance) Field (5)

Determines the correct location for reporting on a Certificates. The standard invoice codes 01 Administrative Fund, 05 Administrative Fund Special, 07 Sinking Fund, 11 Sinking Fund Special will have predetermined positions on the certificate relevant to your state. (For NSW, review the article on NSW Certificates)

Discount Code (6)

This is the number that is set to a levy fund if the levy has a discount available, however must be used for standard levy invoice codes 01, 05, 07, and 11. On any other codes it is only required if a discount is applicable. This must be unique within the selected building, but this number can be added across other buildings if required to maintain consistency, if the same levy fund is used in multiple buildings. The Discount Code and the Invoice Code cannot use the same number.

Discount Account (7)

The general ledger account code that is used for discount transaction when levies are created. This must be a unique number for each Invoice Code and is only required if the levy has discounts available.

Discount Description (8)

The name of the discount for the levy it relates to. This appears on various reports and is only required if the levy has a discount available.

Advance Account (9)

Account code to report advanced levy payments on the Balance Sheet. The same account code can be used to group like transactions into the same account code on the Balance Sheet.

Arrears Account (10)

Account code to report levy arrears on the Balance Sheet. The same account code can be used to group like transactions into the same account code on the Balance Sheet.

Sort Order (11)

The Sort Order is used for reporting on Levy Notices, based on ascending order and must be uniquely numbered within the selected building but this number can be added across other buildings if required to maintain consistency, if the same levy fund is used in multiple buildings.

Posting Priority (12)

This is used for receipting purposes to work out which fund/s money will be allocated to. StrataMax will receipt to the oldest due date for levies & invoices; if multiple levies are due on the same day and the amount paid is less than what is owing; the money will be allocated to the fund/s in order of posting priority.

If Invoice Code 17 ‘Overdue Interest’ is setup as posting priority 1 (or the lowest number of all funds); then Overdue Interest will be allocated to first and then any remaining amount will be allocated to other funds based on oldest due date & posting priority where due dates are the same. The Posting Priority must be unique for each fund.

Charge Interest (13)

The icon indicates how interest charging has been configured for the levy invoice code.

- The blue circle with a question mark indicates 'Levies (Charge Interest)' is selected.

- The red 'X' means 'Do Not Charge Interest' is selected.

- No icon means 'Invoices (Charge Interest)' is selected.

The red 'X' Button (14)

Clicking this will delete the invoice code from the list. It will only be available if the invoice code hasn't been used already.

Levy Invoice Code Setup | Notifications

The far right hand column will identify any invoice codes that have errors or indicates that an Invoice Code can be deleted. Hover over the exclamation point to identify the error.

Indicates Invoice code has not been used and may be deleted.

Indicates Invoice code has not been used and may be deleted.

Invoice Code has errors, highlight for specific details and correct.

Invoice Code has errors, highlight for specific details and correct.

Invoice Code has errors and not been used and may be deleted.

Invoice Code has errors and not been used and may be deleted.

Levy Invoice Code Setup | Add a new Levy Invoice Code

Invoice codes may be added to allow for levying to additional income account codes for existing trading funds, or if a newly created trading fund is required, these additional income codes can form part of that new trading account.

- Search or select Levy Invoice Code Setup.

- Click Add to insert a new invoice code and then complete all applicable areas.

- Click Save once all required information is completed and the save option is able to be selected.

Type - This is where you set if the levy is a regular levy, or a special levy and disable a levy invoice code so it can no longer be used.

- Levies – Regular – To indicate the code is for a Regular Levy.

- Levies – Special – To Indicate the code is for Special Levy.

- Invoices – To indicate the code is for an Invoice charge.

- Disabled – To set a code so it can no longer be used.

- System – To indicate the code is a specific System code (E.g. Overdue Interest or Other)

These areas must be unique within the selected building:

- Invoice Code and Income Posting Account.

- Discount Invoice Code and Income Posting Account.

- Sort Order and Posting Priority.

- Balance Field.

Other areas to be completed:

- Description allows up to 20 characters for the name of the Levy or Discount.

- Advance and Arrears codes – can be setup the same as existing levies or different if required to be separated on the Balance Sheet.

Instalments: The number of Instalments will be used when creating levies from the current or next year Budget. Enter the default number of instalments required. This will be used when a Levy Year Rollover is completed to create the correct number of instalments without intervention.

Default Discount %: Enter the Default Discount percentage rate to be used when creating levies using Add - By Budget in Levy Management. This Discount percentage rate is also used on Certificates (Discount for on-time payments).

Any fields that have not been updated as required, there will be yellow warning messages to confirm what fields still require attention.

There is availability for 15 Levy Invoice Codes as Certificate balance fields can be used once only. If additional levies are required, you may consider combining the levies into the one Invoice Code and then raising a Special Levy with the Levy Name entered into the Purpose/ Reason. Alternatively Custom Levies can be created.

Levy Invoice Code Setup | Edit an Existing Levy Invoice Code

If an existing Levy Invoice Code needs to be updated, amendments can be made, then saved to update.

- Search or select Levy Invoice Code Setup.

- Locate the required invoice code for editing, expand by either selecting on the row or clicking the arrow on the left.

- Edit the information that is required to be updated, then confirm all other existing information is correct and no errors have been identified.

- Click Save to update the information.

Editing an invoice code can be used to:

- Amend the existing levy description for levy notices.

- Update or correct the income account code if it changes.

- Update the advance or arrears account codes on the Balance Sheet.

- Correct any identified errors.

Levy Invoice Code Setup | Delete a Levy Invoice Code

When there are invoice codes that have not been used in the selected building and a cross appears to the right, it can be deleted and the changes saved. If the invoice code is reporting possible errors and has not been used, these can also be deleted.

- Search or select Levy Invoice Code Setup.

- Highlight the invoice code displaying the ‘X’ symbol and select the red X (delete) button.

- Repeat for any other invoice codes that may be required to be deleted.

- Click Save once all invoice codes have been removed, to update the selected building.

Ensure that invoice codes with errors are resolved to allow the ‘Save’ option to be able to be selected and save any updates.

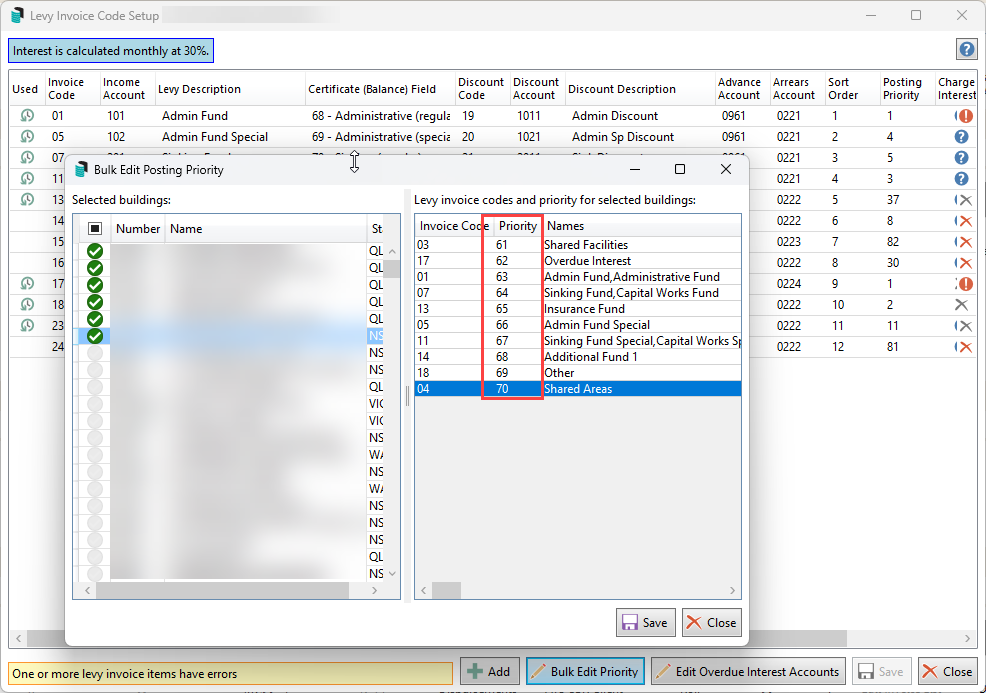

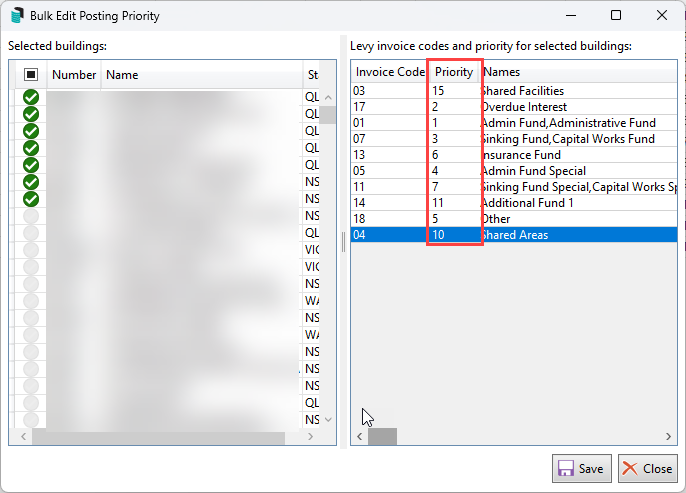

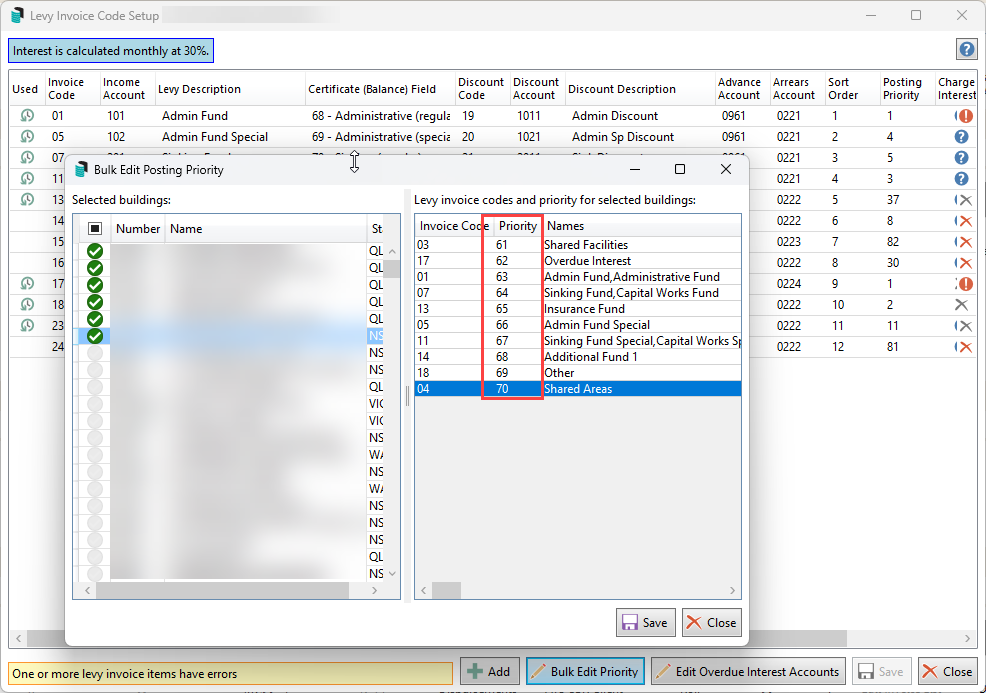

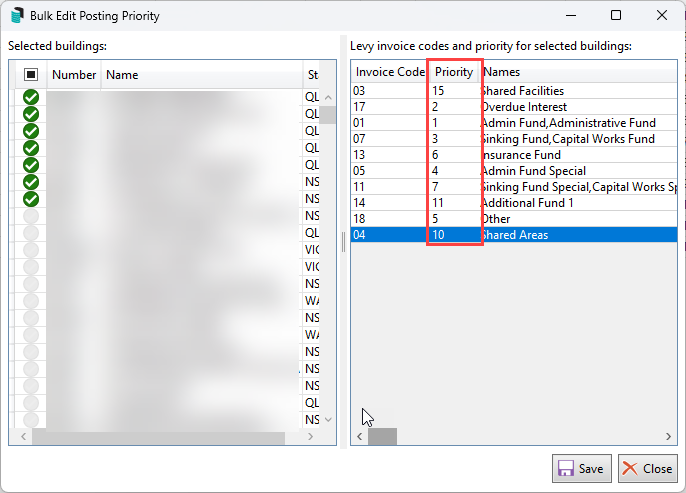

Levy Invoice Code Setup | Bulk Edit Priority

As each building will have their own individual Levy Invoice Codes, a consistent Posting Priority may be required to ensure that all receipts are treated the same way. Bulk Edit Priority allows the priority of the invoice codes to be updated for receipting payments.

The list displayed will show the Building Name and Number as well as the State on the left-hand side. The column headers can be clicked to adjust the sort preference. This changes the list from ascending to descending and back again.

Warnings will be shown if there are posting priorities that have been used more than once and may require amendment. Changes will not be able to be saved if there are unresolved warnings. Due to each building potentially having a different priority, the instructions below will adjust these to a temporary number sequence and then apply again to uniform the number sequence. If this process is being considered for interest priority, please check the configuration in Receipt Entry for state specific configuration which may be taking priority.

- Search or select Levy Invoice Code Setup.

- Click Bulk Edit Priority.

- All buildings will be selected, amend as applicable and untag if required.

- Review the Levy Invoice Code priority list and assign the required priority against each fund type by double-clicking on Priority for the invoice code and entering a number. Numbers cannot be repeated. If changing multiple priorities, this will need a temporary number sequence applied. For example: using a priority number that it outside of anything used.

- Click Save.

- Now amend the priority to the bulk numbers as required. Click Save once all priorities are set to save the changes.

Please contact the Support Team should you require additional assistance with other bulk changes in this area.

Levy Invoice Code Setup | Edit Overdue Interest Accounts

The Overdue Interest Invoice Code is set to a specific number as it is a system code, however the overdue interest income transaction is posted to their respective funds. The Edit Overdue Interest Accounts button will open the Trading Fund Setup screen where the income code for the overdue interest is set. This is used as a shortcut to adjust the income code if required.

- Search or select Levy Invoice Code Setup.

- Click Edit Overdue Interest Accounts.

- Review each fund and click the ellipses button [...] to the right of the 'Overdue Interest Code'.

- Select the account to update for future interest transactions to process to and click OK.

- Click Save after amending all required funds.

- Click Close on the Trading Fund Setup screen to return to the Levy Invoice Code Setup screen.

- Click Save if there have been changes made.

If the account is not in the local chart of accounts, use Account Maintenance to add from the Master Chart (while the Trading Fund Setup screen is still open), then the account will be able to be selected in the Trading Fund Setup.

Levy Invoice Code Setup | Base Building

Levy Invoice Codes can be set up in the Base Building to allow newly created buildings to be created with a standard set of invoice codes. The setup should be reviewed to determine that the current invoice codes allow for growth and possible change that each new building may require.

Security settings can be updated to restrict access to the Base Building.

- From the Building Selector, click Select Base Building.

- Search or select Levy Invoice Code Setup.

- Review each invoice code as this will be what is used for any new buildings created.

- Any Additional Funds that are not required click the red X (delete) button. These are additional and not required for the standard setup

- To add any standard funds that is required for each newly created building, follow the Add Levy Invoice Code steps above.

- Click Save once the Levy Invoice Codes have been reviewed and saved.

Levy Invoice Code Setup | Show Building Interest Rate

The interest rate configured for the building/ property will be displayed in Levy Invoice Code Setup. A message will advise if interest is enabled as well as the rate of charged interest and the starting date.

Levy Invoice Code Setup | Interest Options

Interest options are configured in Levy Invoice Code Setup.

Levies (Charge Interest)

This option will only charge interest where a levy is associated with the selected Invoice Code. This is the default.

Invoices (Charge Interest)

This option will allow interest to charge on overdue amounts. The due date for invoices will be taken into consideration in the calculation.

Do Not Charge Interest

This will disable interest for the selected Invoice Code.

Levy Invoice Code Setup | Troubleshooting

What should be done if the ‘save’ icon not accessible?

Check the existing invoice codes for errors, highlighted on right with an exclamation and also noted at the bottom left of the screen with ‘One or more levy invoice items have errors’

If there is an error, how do I identify what it is?

Locate the invoice code with the exclamation notification on the right side of the screen, then either hover across the icon to reveal the issue or select the row to expand and read the message at the bottom left of the selected row.

What should be done to close / collapse the selected row?

Re-select the row or press the Esc key on your keyboard.

If there is an income or discount account missing or not available when adding / editing an invoice code, how do I add without losing changes already entered, but not yet able to be saved?

Leave the Levy Invoice Code Setup screen open, and open Account Maintenance to add the required account/s from the Master Chart or create New account/s adding to the local and Master Chart at the same time. Then select the newly added income account and save.

When a building is transferred in, what areas can and cannot be changed?

The Income Account, Levy Description, Balance Field, Discount Account, Discount Description, Advance Account, Arrears Account, Sort Order and Posting Priority can be amended to reflect the portfolio requirement. The Invoice Codes and Discount Codes should not be adjusted.

Example of Levy Invoice Codes with errors to be resolved.